Prior to making purchases the retailers’ websites should be checked to find any current promotions being offered.įor more information on the SNAP Online Purchasing Program, please see the DHHS Press Release: NH DHHS Announces Online Purchasing Program For SNAP Recipients. Walmart can accept both EBT SNAP and Cash purchases, with cash being able to be used for any additional fees and non-SNAP approved items.Īmazon, ALDI, Walmart, BJ’s, Price Chopper, Hannaford, and Price Rite may offer promotions at different times and delivery fees may be charged. Amazon, ALDI, BJ’s, Price Chopper, Hannaford, and Price Rite can accept EBT SNAP purchases on SNAP approved items only, and any additional fees (such as delivery fees) must be paid via another form of payment. See the COVID-19 Data on DHHS Client Services ProgramsĮBT cardholders are now able to make online purchases at Amazon, ALDI, Walmart, BJ’s Warehouse Club (BJ’s), Price Chopperm, Hannaford, and Price Rite.

Ĭontact your local Community Action Agency to apply today. If you receive SNAP, Medicaid, or cash assistance benefits, you may be eligible to receive utility assistance through the Electric Assistance Program and the Fuel Assistance and Weatherization Assistance Programs. CTC UP will allow you to unenroll before the first advance Child Tax Credit payment is made.

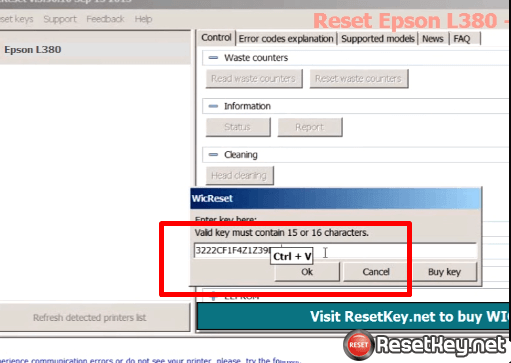

#Free wic reset utility update#

If you would rather claim the full credit when you file your 2021 tax return or you know you won’t be eligible for the Child Tax Credit for your 2021 tax year, you can unenroll through the Child Tax Credit Update Portal (CTC UP). If the IRS has processed your 2020 or 2019 tax return, these monthly payments will be made starting in July and through December 2021, based on the information contained in that return. There have been important changes to the Child Tax Credit that will help many families receive advance payments.Īdvance Child Tax Credits (ACTC) payments are early IRS payments from the of 50 percent of the estimated amount of the Child Tax Credit that you may claim on your 2021 tax return during the 2022 tax filing season. Read more about the changes in this update from the US Food and Nutrition Servicesĭon’t forget about the new Advance Child Tax Credit Payments This was a temporary change and will expire at the end of September, 2021. You will have received a notice letting you know the amount of your benefit.Īs a result of the COVID pandemic, SNAP benefits increased for all households by 15%. These included changes to income limits, the maximum amount of SNAP benefits you can receive, and the amount of deductions you can claim. Beginning October 1, 2021, Federal and State laws will change the Supplemental Nutrition Assistance Program (SNAP).

0 kommentar(er)

0 kommentar(er)